blame our voting system. If we have a more proportional share of seats at Westminster, we'll embrace coalition governments which will always result in a more balanced politics and less of giveaway budgets.Yet if all the parties now take the outcome of the election as a signal to spend money we don’t have then bankruptcy is not far away.

Brexit, for once some facts.

- Thread starter flecc

- Start date

Way back down in the long gone depths of thread I suggested that the only logical form of Government was thisblame our voting system. If we have a more proportional share of seats at Westminster, we'll embrace coalition governments which will always result in a more balanced politics and less of giveaway budgets.

Since all Members of Parliament are elected to serve their constituents, it clearly a crime that most of them are excluded from doing the job they were elected to do.

Hence all Governments should be coalitions, and any power groups (parties) should only hold ministerial or other posts in proportion to the number of seats they hold, as a secondary consideration to their abilities to do the job.

The only problem I can foresee with this idea is that there would be areas of high competition, such as cleaning the toilets and organising the car parking.

20 countries out of the EU27 have coalition governments.

The common form is the largest party + a liberal party.

In the UK, the liberals are seen as a joke.

No wonder we don't fit in.

The common form is the largest party + a liberal party.

In the UK, the liberals are seen as a joke.

No wonder we don't fit in.

That at least is worth a response,Yet if all the parties now take the outcome of the election as a signal to spend money we don’t have then bankruptcy is not far away.

Unless Brexit costs Nix, Zero or Zilch, and incurs no loss of income then all will be as you have foreseen.

Congratulations! the sheer horror of our situation, revealed in one Swell Foop.

Ignore me, I'm having one of my turns......someone hit the offensive language button for me.

(Not Zlatan, as the last time he did he scored an "own Goal")

If you don't stop telling the truth I shall hit the "offensive language" button.20 countries out of the EU27 have coalition governments.

The common form is the largest party + a liberal party.

In the UK, the liberals are seen as a joke.

No wonder we don't fit in.

Think of our street credibiilty!

But really all elected Mps should be able to exercise the mandate the public gave them. not just become spare parts.

Well done. you have revealed the world economy is actually a "Chain letter"we just borrow from our banks, which borrow from froreign banks, and ultimately, from all the big countries' central banks printing paper money.

We are all links in a chain.Well done. you have revealed the world economy is actually a "Chain letter"

Nonsense, there only seems to be one party that even recognises the need to live within our means. Now that one finds itself clinging on, it too would seem to be in danger of falling for the thought that you can spend yourself out of a massive overdraft. It doesn't of course but obviously needs to give that illusion. Apart from that what do you think local poltics are for - local politics! National politics = national interestsblame our voting system. If we have a more proportional share of seats at Westminster, we'll embrace coalition governments which will always result in a more balanced politics and less of giveaway budgets.

but we don't, do we?Nonsense, there only seems to be one party that even recognises the need to live within our means.

if we were to live within our means, we wouldn't start by doing our best to destroy our own planet.

We wouldn't start wars in the hope that the spoils are going to pay for the cost of wars.

Even the EU accepts 3% budget deficit is stable enough.

All economists accept that a moderate inflation of 2% is beneficial, otherwise a lot of people won't get a pay rise. You need to keep the money supply going.

As for the tories, living within our means has never been practiced. It is a white lie. If they really mean it, they wouldn't be able to cut taxes.

Last edited:

How could I let this go unchallenged other than the last sentence, that's OK.Way back down in the long gone depths of thread I suggested that the only logical form of Government was this

Since all Members of Parliament are elected to serve their constituents, it clearly a crime that most of them are excluded from doing the job they were elected to do.

Hence all Governments should be coalitions, and any power groups (parties) should only hold ministerial or other posts in proportion to the number of seats they hold, as a secondary consideration to their abilities to do the job.

The only problem I can foresee with this idea is that there would be areas of high competition, such as cleaning the toilets and organising the car parking.

I might be old fashioned, but, I expect my government to lead, not manage daily by concensus. Whilst the constituent MP's might not make the decsions they do have influence and that is their role surely? If they have specific skills they serve on committees, all of which are cross-party.

MP's are surely elected to serve the 'best interests' of their constituents?

Last edited:

but we don't, do we?

if we were to live within our means, we wouldn't start by doing our best to destroy our own planet.

We wouldn't start wars in the hope that the spoils are going to pay for the cost of wars.

Even the EU accepts 3% budget deficit is stable enough.

All economists accept that a moderate inflation of 2% is beneficial, otherwise a lot of people won't get a pay rise. You need to keep the money supply going.

As for the tories, living within our means has never been practiced. It is a white lie. If they really mean it, they wouldn't be able to cut taxes.

This just gets worse. First off you seem to ignore that the deficit is rather more than you say. Then you want to change the subject. This might help you focus:

The claim: Prime Minister Theresa May said that the Conservatives had, over the past seven years, cut the nation's deficit as a share of GDP by almost three-quarters.

Reality Check verdict:The amount being borrowed each year has been reduced from 9.9% of GDP when the coalition government took power in 2010 to 2.6% of GDP in 2016 under the Conservative government, a reduction of almost three-quarters. But while the amount being borrowed each year has been falling, the overall debt is still rising.

Prime Minister Theresa May said that Conservative-led governments had dramatically reduced the deficit since 2010.

At a news conference on Wednesday she said: "Over the last seven years... we have taken the British economy out of the danger zone. The deficit has come down by almost three-quarters as a share of GDP."

To examine that claim let's first clear up what we are actually talking about.

Deficit

This is the difference between the amount the government spends and how much it receives in taxes and other income.

If the government spends more than it takes in, then it's in deficit. If it receives more than it spends, it's in surplus.

Every month the Office for National Statistics (ONS) measures the deficit using a specific figure: public sector net borrowing.

That might sound technical, but it's just how much the government has borrowed to cover its shortfall, minus items like cash and other liquid assets.

Importantly the figure excludes borrowing by Royal Bank of Scotland, which is 73% owned by the government.

That is such a huge number that it would dominate the figures if it was included.

Debt

So what happens when the government spends more than it takes in?

Well, it borrows and that borrowing is added to the overall debt pile.

The accepted and widely used figure for debt is actually the net debt of the UK; in other words, the total debt minus the government's liquid assets.

An easy way to compare debt levels across different countries is to express debt as a percentage of total economic output, or GDP, which is why you'll hear commentators talk about the debt-to-GDP ratio.

The government can't start cutting the debt pile until it starts running a surplus, which means eliminating that pesky deficit.

So what's been happening to the deficit?

In 2010 when the coalition government took over, the new chief secretary to the Treasurywas famously left a noteby his predecessor.

"I'm afraid there is no money," it read.

And he wasn't joking.

The UK was hit by recession in 2008 following the financial crisis, and to cover its outgoings the government had to borrow a record £154bn in 2009.

By the time the coalition took over in 2010 that had fallen slightly to £144bn, equivalent to 9.9% of GDP.

The new Chancellor of the Exchequer, George Osborne, announced an austerity package of tax rises and swingeing spending cuts in his June 2010 budget.

He vowed to balance Britain's bookswithin five years- a promise that was to cause him a lot of trouble.

While the deficit did fall by almost half by 2015, it was still nearly £80bn for the year.

Philip Hammond took over as chancellor in 2016 andhas seen the deficit fall further.

For the financial year to the end of March 2017, the deficit was £52bn or 2.6% of GDP.

Mr Hammond has not set a hard deadline for when that will be reduced to zero.

Instead, in their 2017 manifesto, the Conservatives pledged to eliminate the deficit by the "middle of the next decade".

Where have the austerity measures fallen?

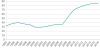

As the chart above shows, austerity measures since 2010 have not fallen evenly on government departments.

The hefty cuts have fallen on transport, work and pensions and local government and they can expect further cuts over the next few years.

Hang on! What about debt?

As the chart above shows, before the financial crisis, debt as a percentage of the economy was less than 40%.

But when the 2008 recession hit, the government borrowed heavily and debt increased dramatically.

The Office for Budget Responsibility expects debt as a percentage of national income to peak in the current financial year at 88%, the highest level since 1966.

The UK has the sixth-largest government debt of advanced economies.

To start cutting that debt to GDP ratio the government needs to start running a surplus or the economy needs to start growing more quickly.

This report was updated on 18 May 2017 to reflect the Conservative Party Manifesto.

Attachments

-

17.7 KB Views: 2

-

18 KB Views: 2

The drawback to this is simply that no conceivable surplus will eliminate the national debt in a hundred years, and now to add to the burden, the last thing we need is brexit, which will make matters far worse.

Sent from my XT1032 using Tapatalk

Sent from my XT1032 using Tapatalk

Then you are against the rule of democracy, just want factional power.How could I let this go unchallenged other than the last sentence, that's OK.

I might be old fashioned, but, I expect my government to lead, not manage daily by concensus. Whilst the constituent MP's might not make the decsions they do have influence and that is their role surely? If they have specific skills they serve on committees, all of which are cross-party.

MP's are surely elected to serve the 'best interests' of their constituents?

I expect parliament to represent the people not the most gullible section of it

Sent from my XT1032 using Tapatalk

Peter, if you eliminate the deficit (a perfectly balanced budget or you are in surplus), then you do not run the economic engine to the best.This just gets worse. First off you seem to ignore that the deficit is rather more than you say. Then you want to change the subject. This might help you focus:

As John Maynard Keynes wrote in 1937: “The boom, not the slump, is the right time for austerity at the Treasury.”

Trust me on this, I can bore you to death with the reasoning.

That's why we have elections - if you/they don't like what has been done in your name then you can vote to give someone else a try at running the country. There's more than enough in-party fighting without adding the whole lot to it. That would be total chaos - not unlike a bunch of students debating whatever.Then you are against the rule of democracy, just want factional power.

I expect parliament to represent the people not the most gullible section of it

Sent from my XT1032 using Tapatalk

I trust you - on that at least.Peter, if you eliminate the deficit (a perfectly balanced budget or you are in surplus), then you do not run the economic engine to the best.

As John Maynard Keynes wrote in 1937: “The boom, not the slump, is the right time for austerity at the Treasury.”

Trust me on this, I can bore you to death with the reasoning.

Well, that didn't last long - the boredom bit's OK but as I recall Germany has been running a surplus for quite a while.

Just checked my facts. This from New York.

If that’s the case, why did I start off by saying that Germany’s trade surplus is a problem? Last year, Germany’s global trade surplus surpassed that of China for the first time. Together, Germany and China’s surpluses create dangerous forces in the global economy. In normal times, money should flow, relatively freely, from nation to nation. As a general rule, people save money in banks, and the banks lend that money to businesses, which use it to invest in new factories, services, and government bonds. Some nations have more money saved than they do businesses that deserve investment; the extra money goes to some other nation with more promising businesses. In theoretical models, these flows of money are self-correcting. If one nation attracts too much investment or another attracts too little, then their exchange rates will adjust, and the money will stop flowing from the cash-rich nation to the investment-rich one.

With Germany, this hasn’t happened. There is a growing hoard of cash piling up because Germans tend to save a lot, as does their government. While Germany has strong industries, it doesn’t have the Internet, biotech, and robotics hubs that make the U.S. so attractive to foreign investors. Germany also greatly benefitted from the creation of the eurozone, which increased exports of German goods to other European countries. The 2008 financial crisis was caused, in no small part, by a similaramassing of cash, particularly in China. Back then, China had so much money looking for a place to invest that it started pouring into U.S. real estate and other ill-fated investments. This helped create the enormous housing bubble, which, when it burst, left us in crisis. It’s not clear exactly what the long-term impact of Germany’s cash hoarding will be. But the longer it builds and the bigger it gets, the more likely that it will erupt in some ugly and damaging way. Two prominent European think tanks found that more than two-thirds of economists surveyed believe that German surpluses are “a threat to the Eurozone economy.” The Obama Administration thought so, too.

The solution to Germany’s surplus has nothing to do with trade deals or the particular deal-making skills of government officials, as Trump would suggest. Rather, it’s a difficult and challenging dilemma that will likely have to be resolved by the European Central Bank. Germany needs a stronger euro, so that its citizens can buy more goods from abroad and export less, reducing its surpluses. But a stronger euro would be disastrous for Greece, Portugal, Italy, and other poorer members of the eurozone, which need a weaker currency to encourage exports and discourage consumer spending. This would be made easier by a political and fiscal union like the one in the United States. Our central and state governments continuously handle the disparate economies within our borders. We take tax money from high-growth areas and redistribute it to low-growth ones. Silicon Valley, in effect, subsidizes Mississippi. (Interestingly, blue states generally subsidize red ones.)

Germany could also spend more of its money on infrastructure or public projects of some kind. If Germany doesn’t take steps to reduce its trade surplus, at some point, if past patterns predict the future, there could be the discovery of a bubble in Germany or somewhere else in the eurozone, a sudden market panic, and a collapse of confidence, leading to stock-market collapse and recession. It could rend the eurozone apart. Such a crisis might be a short-term boon for the United States, as investors seek its safety, but it would also cause consternation in the global economy. It used to be assumed that the U.S. leadership considered global stability as a form of self-interest. A sudden collapse of Germany’s surplus could lead to the type of economic disaster that often spurs political instability, a lack of global coöperation, and a turning toward ugly forms of nationalism.

Last edited:

several countries run trade surplus such as Germany, Japan and China but that is not the same as BUDGET SURPLUS.If that’s the case, why did I start off by saying that Germany’s trade surplus is a problem?

China runs a budget defict of 3.8% last year. Japan runs a budget deficit of 4.5% last year. Germany is the exception, 0.8% surplus last year.

Germany runs about the smallest budget deficit for their economic cycles among countries with advanced economy, about 2% dficit on average. It says something about the success of coalition governments in preserving strong economies.

Those are even better circular arguments than even Zlatan uses!I trust you - on that at least.

Well, that didn't last long - the boredom bit's OK but as I recall Germany has been running a surplus for quite a while.

Just checked my facts. This from New York.

If that’s the case, why did I start off by saying that Germany’s trade surplus is a problem? Last year, Germany’s global trade surplus surpassed that of China for the first time. Together, Germany and China’s surpluses create dangerous forces in the global economy. In normal times, money should flow, relatively freely, from nation to nation. As a general rule, people save money in banks, and the banks lend that money to businesses, which use it to invest in new factories, services, and government bonds. Some nations have more money saved than they do businesses that deserve investment; the extra money goes to some other nation with more promising businesses. In theoretical models, these flows of money are self-correcting. If one nation attracts too much investment or another attracts too little, then their exchange rates will adjust, and the money will stop flowing from the cash-rich nation to the investment-rich one.

With Germany, this hasn’t happened. There is a growing hoard of cash piling up because Germans tend to save a lot, as does their government. While Germany has strong industries, it doesn’t have the Internet, biotech, and robotics hubs that make the U.S. so attractive to foreign investors. Germany also greatly benefitted from the creation of the eurozone, which increased exports of German goods to other European countries. The 2008 financial crisis was caused, in no small part, by a similaramassing of cash, particularly in China. Back then, China had so much money looking for a place to invest that it started pouring into U.S. real estate and other ill-fated investments. This helped create the enormous housing bubble, which, when it burst, left us in crisis. It’s not clear exactly what the long-term impact of Germany’s cash hoarding will be. But the longer it builds and the bigger it gets, the more likely that it will erupt in some ugly and damaging way. Two prominent European think tanks found that more than two-thirds of economists surveyed believe that German surpluses are “a threat to the Eurozone economy.” The Obama Administration thought so, too.

The solution to Germany’s surplus has nothing to do with trade deals or the particular deal-making skills of government officials, as Trump would suggest. Rather, it’s a difficult and challenging dilemma that will likely have to be resolved by the European Central Bank. Germany needs a stronger euro, so that its citizens can buy more goods from abroad and export less, reducing its surpluses. But a stronger euro would be disastrous for Greece, Portugal, Italy, and other poorer members of the eurozone, which need a weaker currency to encourage exports and discourage consumer spending. This would be made easier by a political and fiscal union like the one in the United States. Our central and state governments continuously handle the disparate economies within our borders. We take tax money from high-growth areas and redistribute it to low-growth ones. Silicon Valley, in effect, subsidizes Mississippi. (Interestingly, blue states generally subsidize red ones.)

Germany could also spend more of its money on infrastructure or public projects of some kind. If Germany doesn’t take steps to reduce its trade surplus, at some point, if past patterns predict the future, there could be the discovery of a bubble in Germany or somewhere else in the eurozone, a sudden market panic, and a collapse of confidence, leading to stock-market collapse and recession. It could rend the eurozone apart. Such a crisis might be a short-term boon for the United States, as investors seek its safety, but it would also cause consternation in the global economy. It used to be assumed that the U.S. leadership considered global stability as a form of self-interest. A sudden collapse of Germany’s surplus could lead to the type of economic disaster that often spurs political instability, a lack of global coöperation, and a turning toward ugly forms of nationalism.

And you have managed to make a case that we are better off with a deficit than a surplus.

I make this a win on points for Woosh, and your argument if we were (in the unlikely event) to follow it, would just make matters worse.

And we already have the ugly form of Nationalism in our very own home grown Brexit.

Truly it is amazing that the Orwellian concepts of lies equalling the truth are now taken as universal constants in the Conservative version of reality.

Lie number one

"We take tax money from high-growth areas and redistribute it to low-growth ones. "

From where exactly and to where exactly?

Lie number two

"It’s not clear exactly what the long-term impact of Germany’s cash hoarding will be. But the longer it builds and the bigger it gets, the more likely that it will erupt in some ugly and damaging way."

So how is that going to happen? and why?

Answer this simple question can a rich country survive a crash better that a poor one?

Germany certainly took the last crash in it's stride.

Tell Norway with it's $990bn oil fund that we could have had if Thatcher and co hadn't lined someone's pockets with it

The fund is one of the biggest investors in the world, with a bonds portfolio of about $320bn.

And you are expecting the very same Clowns who fumbled the ball over oil and gas to work miracles with Brexit?

Sorry I must stop, it's just too Funny to be true.

Last edited:

Whereas we have a pack of Hyenas snarling at each other behind closed doors and presenting a face contorted into mock calm and bonhomie to the public, while stabbing them in the back?That's why we have elections - if you/they don't like what has been done in your name then you can vote to give someone else a try at running the country. There's more than enough in-party fighting without adding the whole lot to it. That would be total chaos - not unlike a bunch of students debating whatever.

Some choice.

Actually this is where the mistake comes in, Party Politics mean that a shadowy group decides which controllable goon is sponsored as a Candidate, thus the system in a Tory district can, due to a total lack of talented volunteers, vote for a Lord Charles puppet and produce the Rees Moggs, Goves, Borises, and Davis's of this world, who simply oppose progress in any form and make a nuisance of themselves trying to bring Medieval Blood Sports back, ruining the Environment and putting society firmly on a backward track to the Middle Ages.

So all the candidates belonging to the opposition parties, equally qualified by being elected by the voters have to take menial jobs while the clowns belonging to the faction that conned the most voters runs riot?

Democracy? never in a Million Years, just mob rule.

And then to cap it all, this party manages to spawn a rabid offspring UKIP which takes control of its direction and frightens it, and it foolishly agrees to a Brexit referendum, which it not only loses, but the Maybot even loses her parliamentary majority pretending to be "Strong and Stable" and has to buy the support of a bunch of nut jobs to stay in power.

I have to admire the sheer "Brass" you display when expounding how wonderful the Tories are and they know what's best for the Future of the nation and it's economy.

They couldn't run a Whelk stall at the seaside.

Really, that is deliciously Funny!

Always the problem with cut n' paste. You too should know that.Those are even better circular arguments than even Zlatan uses!

And you have managed to make a case that we are better off with a deficit than a surplus.

I make this a win on points for Woosh, and your argument if we were (in the unlikely event) to follow it, would just make matters worse.

And we already have the ugly form of Nationalism in our very own home grown Brexit.

Truly it is amazing that the Orwellian concepts of lies equalling the truth are now taken as universal constants in the Conservative version of reality.

Lie number one

"We take tax money from high-growth areas and redistribute it to low-growth ones. "

From where exactly and to where exactly?

Lie number two

"It’s not clear exactly what the long-term impact of Germany’s cash hoarding will be. But the longer it builds and the bigger it gets, the more likely that it will erupt in some ugly and damaging way."

So how is that going to happen? and why?

Answer this simple question can a rich country survive a crash better that a poor one?

Germany certainly took the last crash in it's stride.

Tell Norway with it's $990bn oil fund that we could have had if Thatcher and co hadn't lined someone's pockets with it

The fund is one of the biggest investors in the world, with a bonds portfolio of about $320bn.

And you are expecting the very same Clowns who fumbled the ball over oil and gas to work miracles with Brexit?

Sorry I must stop, it's just too Funny to be true.

Your lies are interesting

1. In a US of Europe or indeed the States scenario. Surely there is no other way? It's a bit like water it finds a level and if one cup has more than another it will need to lose some of it to level things out. That surely, is the whole philosophy of the EU master plan? Come along you poor countires we will make you rich - in return for what exactly?

2. I too doubt Germany will be able to continue with a massive trade surplus but if it did so, then, much as now, it will dominate the EU and that will upset peoples, seriously upset them. Have's and Have-nots. When the rebalancing comes that will then upset the Germans for sure.

No doubt that a rich counrty can survive a finacial crash better thah one that is virtually bankrupt - why even ask? This thread was more about a deficit not a financial crash and they are not mutually inclusive, nor circular come to that. There are plenty of countries that fail without needing a crash to make it happen - they simply spend more than they have or would be able to create