Politically we are in a right mess we seem to have politicians who have only known being in the EU and they are not fit for office in my opinion. I was a long time supporter of the Liberal Democrats and actually voted to remain in the EU but then I asked a few questions about how they would stop the trade inbalance and restore industry and the conversation online on a forum with a party member was shocking in their complete stupidity about the economy and lack of understanding about the debt. I actually felt ashamed I had supported them. I personally feel Labour and Conservatives are the most competent parties because they have a subset of members who understand the huge damage the EU has caused and other parties are far worse. I have little confidence in the Labour party to improve on the Conservatives. There are both Conservatives and Labour politicans I would like to see in power over the current leaders but the current state of politics for me is extremely poor overall. All they do is borrow and create more problems for future generations.what do you think if the Labour party wins the next election?

parts an prices from china

- Thread starter luap321

- Start date

Your bigotry on this subject makes you distort everything against the EU, quite simply you've been brainwashed. No, I'm not mad, nor am I idealistically motivated. I'm just far more experienced that you and know at first hand the whole history if our decline since the 1930s, before the EU even existed.Are you mad France and Spain has crippling issues like ourselves and huge debts. The EU has been a huge disaster for many countries of Europe. What do you mean continued failures, just because we leave the EU it doesn't mean the industries return in a puff of smoke or the huge burden of debt disappears. This is not something debatable surely. Everything is recorded at the office of national statistics. The decline in industry since joining the EU, the huge payments to the EU and the cost of imports increasing. Seems madness to use the unemployed as somehow a case for your argument. So the EU destroyed our industries causing huge unemployment but according to your logic the problem is the unemployed themselves. So we had good employment until we joined the EU and then our industries died because we couldn't compete in the EU and then somehow its the unemployed's fault?

It's madness to open a free trade agreement to a market you can't compete with when your currency is too strong, its madness to send huge payments outside the UK and its madness to be restricted in what you can buy when those restrictions benefit other countries not yourself. This is so simple to understand I can't understand how anyone can argue against it when the statistics are recorded so clearly at the office of national statistics.

Ultimately we are now just a small country without an empire, politics has to operate in the interest of the people and we have to be protected from ourselves and our huge level of imports. We have to balance the books and start making our country more difficult for imports and create more assets within our own country. It is clear to any reasonable logical person that the EU was a huge disaster for the UK as its backed up by a huge number of statistics across all parts fo the economy. This isn't debatable to any logical person.

To rejoin the EU will lead to even higher build up of debts towards £3 trillion maybe £4 trillion or even £5 trillion over time. It will be absolutely crippling with horrific poverty that we haven't seen for generations. It's absolute madness to consider it. The UK is in a very damaged state and needs some isolation and independent policies to go into repair mode. At this point we have to focus on returning to a trade surplus which cannot be done within the EU as they will continue to dictate hugely damaging policies to us and push their own products. We have lost a huge amount of skills and industrial capacity.

How on earth would we correct the economy in the EU? What policies do you propose to restore a trading surplus and stop borrowing. I just can't see how any logical person would ever suggest rejoining the EU. I know of no logical ways we can repair our economy within the EU unless we half our pay rate or do some other drastic measures so we can compete in Europe.

Lets say we are less productive and more lazy as your unemployed jibe hinted well that in itself would show surely we are not suitable for the EU because we cannot compete in that marketplace so have to be protected from it. It's clear we cannot compete in the EU every statistic shows that and if you are implying we are lazy etc then your argument is we must leave the EU. The only reason to join the EU is surely we will do well in it and profit from it but not even you with your warped and strange logic would go that far surely when every bit of data shows that is untrue. If we failed because of our own incompetence that means surely we are incapable of competing in that marketplace. I just don't get your point of view it seems politically or idealistically motivated with zero logic behind it.

You say this:

"This isn't debatable to any logical person."

when in fact it is very debatable to 58% of our population now and was to 48% at time of the referendum when they voted to remain.

The only difference leaving the EU will make is speeding up our decline. That is already happening and why we are being so careful to leave the door open to hang onto what we have and to be able to return to the EU in some way if necessary.

.

If you think the average voter has a informed opinion on whether we should be in or out of the EU, you’re delusional.

The referendum should have never happened. But it did. So now we get on with it.

The problem in this country is career politicians. They’re genuinely ******* stupid.

You only have to look at Diane Abbot sat on the tube with 2 left shoes (one black, one brown) sipping a can of g&t.

Its a broken system.

The referendum should have never happened. But it did. So now we get on with it.

The problem in this country is career politicians. They’re genuinely ******* stupid.

You only have to look at Diane Abbot sat on the tube with 2 left shoes (one black, one brown) sipping a can of g&t.

Its a broken system.

A few modifications suggested:If you think the average voter has a informed opinion on whether we should be in or out of the EU, you’re delusional.

The referendum should have never happened. But it did. So now we get on with it.

The problem in this country is career politicians. They’re genuinely ******* stupid.

You only have to look at Diane Abbot sat on the tube with 2 left shoes (one black, one brown) sipping a can of g&t.

Its a broken system.

"If you think the average voter has a informed opinion on just about anything, you’re delusional."

"The referendum happened, but we are not getting on on with it."

Diane Abbot's shoes, the same everywhere among dozy politicians. Remember the President of the European Commission Jean-Claude Juncker wearing two different coloured socks at an international meeting?

.

Odd socks is one thing…….2 left shoes of differing colour? 2 doctors should be paying her a visit.

Then you have her son on crack at work. No surprise his job was a privileged gift.

Successful men with a proven track record should be running the country, and questioning those that do. Not blithering idiots.

Then you have her son on crack at work. No surprise his job was a privileged gift.

Successful men with a proven track record should be running the country, and questioning those that do. Not blithering idiots.

excessive borrowing and selling public assets are mainly a consequence of low tax policy under the conservatives.All they do is borrow and create more problems for future generations.

Just look at the historical data.

Perhaps she's colour blind? She wins every election by a huge margin against anyone the Tories mount.Odd socks is one thing…….2 left shoes of differing colour? 2 doctors should be paying her a visit.

Would you rather he be unemployed on crack?Then you have her son on crack at work. No surprise his job was a privileged gift.

Then perhaps we should be voting for them?Successful men with a proven track record should be running the country, and questioning those that do. Not blithering idiots.

But of course we can't, since no intelligent person with a proven track record will ever stand for election to the impossible job of trying to please all of us.

That's why we only get those who are dumb enough to think that is possible, the fundamental flaw of democracy.

.

That is not the point. The point is they bailed them out and rubbed our noses in it time and time again, and we all watched meekly on while it played out in front of us. If it were almost any other country there would be riots in the streets, but the UK populace just shrugs their shoulders and takes it on the chin again and again.Of course it is. and if you read right through my posts you would see that I've also mentioned similar and the strength of my left wing leanings.

But for two reasons there is no point in saying it:

Firstly it's what children do, "Ah but Miss, John did it too!", in other words lets all be irresponsible. That's not going to achieve anything.

Secondly, even if we took all that money the wealthy minority made and distributed it among all the rest of us, the vast majority, we'd have hardly anything each. We'd still be left with a country of very low productivity, uncompetitive, costly and with too few products, 25% of working age not in employment, widespread abuse of the welfare state, the black economy.

Our failings are across the board from bankers to the rest of us. It is only by sorting the whole country's problems that we will all be better off. So to get a result that primarily means sorting out the majority first.

.

to be fair to the banks, they invented products within the legal framework that our successive governments have put in place. Just look at their solvency rules year after year. We need to tax their profit so our governments facilitate their greater risk taking year after year with the understanding that the BoE will be their lender of last resort. The bankers are guilty, so are the politicians and voters who vote for excessive lending, house price inflation and lots of capital gain allowances.The point is they bailed them out and rubbed our noses in it time and time again

Agreed that is what concludes, but I disagree with your saying what I posted is not the point. It very much is the point that we, the majority, should start the correction process by setting the behavioural examples that shame the politicians.That is not the point. The point is they bailed them out and rubbed our noses in it time and time again, and we all watched meekly on while it played out in front of us. If it were almost any other country there would be riots in the streets, but the UK populace just shrugs their shoulders and takes it on the chin again and again.

Or when there's the frustration of so many not doing that but just meekly accepting our politicians, just move abroad as so many have done, instead of pointlessly complaining.

Many Brits have moved to Germany long ago and were so disgusted with the Brexit vote and British behaviours that large numbers have taken up German citizenship since. One can admire that positive action, but not just that of staying here and complaining.

.

(If you enjoy a scare, look at the "ioniser" video on Clive's channel!

How on earth is it bigotry when my opinion if fact/data based and you have nothing in your corner to support your argument. I think Europe is fantastic with many incredible countries but that doesn't mean an economic political partnership works, it clearly doesn't for the UK for many reasons and has done incredible damage to our economy which can be clearly seen if you look outside your window at the real world in the UK.Your bigotry on this subject makes you distort everything against the EU, quite simply you've been brainwashed. No, I'm not mad, nor am I idealistically motivated. I'm just far more experienced that you and know at first hand the whole history if our decline since the 1930s, before the EU even existed.

You say this:

"This isn't debatable to any logical person."

when in fact it is very debatable to 58% of our population now and was to 48% at time of the referendum when they voted to remain.

The only difference leaving the EU will make is speeding up our decline. That is already happening and why we are being so careful to leave the door open to hang onto what we have and to be able to return to the EU in some way if necessary.

.

Your opinion is utterly unrealistic and idealistic and that sort of mindset has caused huge damage to this country and now many people will suffer and die early because of it. Ultimately we have to return to a trading surplus, pay back our huge debts and that surely is not something that can be achieved in the EU where we would continue with a huge trading deficit with the EU, make huge payments to them and be forced to buy more expensive goods because of their tariffs on goods from many parts of the world. When I look at the BBC website I realise how utterly clueless that organisation is at generating logical and realistic news reports of our economy today and wonder if you have been brainwashed by it. How on earth does someone develop opinions like yours when clearly you can see what the UK is really like when you step outside your front door.

I honestly can't see why its fair to say I have bigotry when all I want is a well run country that can afford to treat its own people compassionately. Borrowing money just means less suffering today but much more suffering tomorrow and that is the point we have reached now. Those debts are now causing huge suffering and the quality of life of most people in this country will deteriorate.

It's just madness to think about rejoining the EU but that is not to say it won't happen. We have become so economically moronic as a people that I could see it happening and of course this will eliminate even the possibility of turning around our economy which at least we have outside the EU if we had politicians who weren't utterly incompetent.

Brexit is here, nobody disputes that but if you look at the real world since the vote in May 2016, have we done any better?I think Europe is fantastic with many incredible countries but that doesn't mean an economic political partnership works, it clearly doesn't for the UK for many reasons and has done incredible damage to our economy which can be clearly seen if you look outside your window at the real world in the UK.

Strange then that the EU countries are now doing so better since we left, but our economy is now the one far worse than theirs overall.How on earth is it bigotry when my opinion if fact/data based and you have nothing in your corner to support your argument. I think Europe is fantastic with many incredible countries but that doesn't mean an economic political partnership works, it clearly doesn't for the UK for many reasons and has done incredible damage to our economy which can be clearly seen if you look outside your window at the real world in the UK.

Your opinion is utterly unrealistic and idealistic and that sort of mindset has caused huge damage to this country and now many people will suffer and die early because of it. Ultimately we have to return to a trading surplus, pay back our huge debts and that surely is not something that can be achieved in the EU where we would continue with a huge trading deficit with the EU, make huge payments to them and be forced to buy more expensive goods because of their tariffs on goods from many parts of the world. When I look at the BBC website I realise how utterly clueless that organisation is at generating logical and realistic news reports of our economy today and wonder if you have been brainwashed by it. How on earth does someone develop opinions like yours when clearly you can see what the UK is really like when you step outside your front door.

I honestly can't see why its fair to say I have bigotry when all I want is a well run country that can afford to treat its own people compassionately. Borrowing money just means less suffering today but much more suffering tomorrow and that is the point we have reached now. Those debts are now causing huge suffering and the quality of life of most people in this country will deteriorate.

It's just madness to think about rejoining the EU but that is not to say it won't happen. We have become so economically moronic as a people that I could see it happening and of course this will eliminate even the possibility of turning around our economy which at least we have outside the EU if we had politicians who weren't utterly incompetent.

All politicians, theirs and ours, are incompetent, simply because only idiots think they can have policies that suit a majority, when in truth a policy that suits more than a small minority is rare. It's the people, not the politicians who make a country, and for some 70 years we've had a terrible problem with productivity in Britain, seriously underperforming much of the advanced world.

For nearly half of that time we were not in the EU, so they could not have been to blame for its origin, which was entirely British. Once again, I was around to see all this happen, you either were not or were having your nappies changed at the time.

.

I can't agree with that at all. As a country runs a trading deficit less money circulates in the economy as more of sterling is held abroad and borrowing and higher taxation is used to add back that money into the economy and its a vicious circle. Also with a surplus of sterling held abroad more assets are purchased from within the UK.excessive borrowing and selling public assets are mainly a consequence of low tax policy under the conservatives.

Just look at the historical data.

It's like with your analysis you are saying the huge trade deficit and huge amount of money sent to the EU is not an issue and doesn't harm the economy what the problem is, is low taxation and that makes zero sense.

When you look at EU contributions on their own before you factor in the huge trade deficit with the EU and being forced to pay more for goods plus the policies that are damaging to the UK its still a financial horror story on its own. Net contributions in blue. Remember from maybe the mid 80s to early 90s these payments were made from borrowing and so its not just that money its the interest on all the borrowing to pay for this on top year by year. So maybe an average of £7 billion a year seems bad but its like 30 years of that plus all the cumulative and compound interest on top of borrowing that money. It's absolutely horrific and a huge burden on our economy. You cannot tax to repair this damage it doesn't work that way. We left the EU with a national debt of about £1.7 Trillion and a good third of that is likely purely on EU contributions in itself. Remember even £7 billion is around £250 per year from every working person but the interest on our overall debts is something like £3k per year per working person now so I guess you could say £1000 interest per year to pay the portion of debt interest related to net EU payment borrowing.

Everyone understands that when a country sells a surplus of products and has high exports that country does well like China but the opposite seems to be politicised in that people think you can run a trading deficit and somehow live to the same standard? It's just madness.

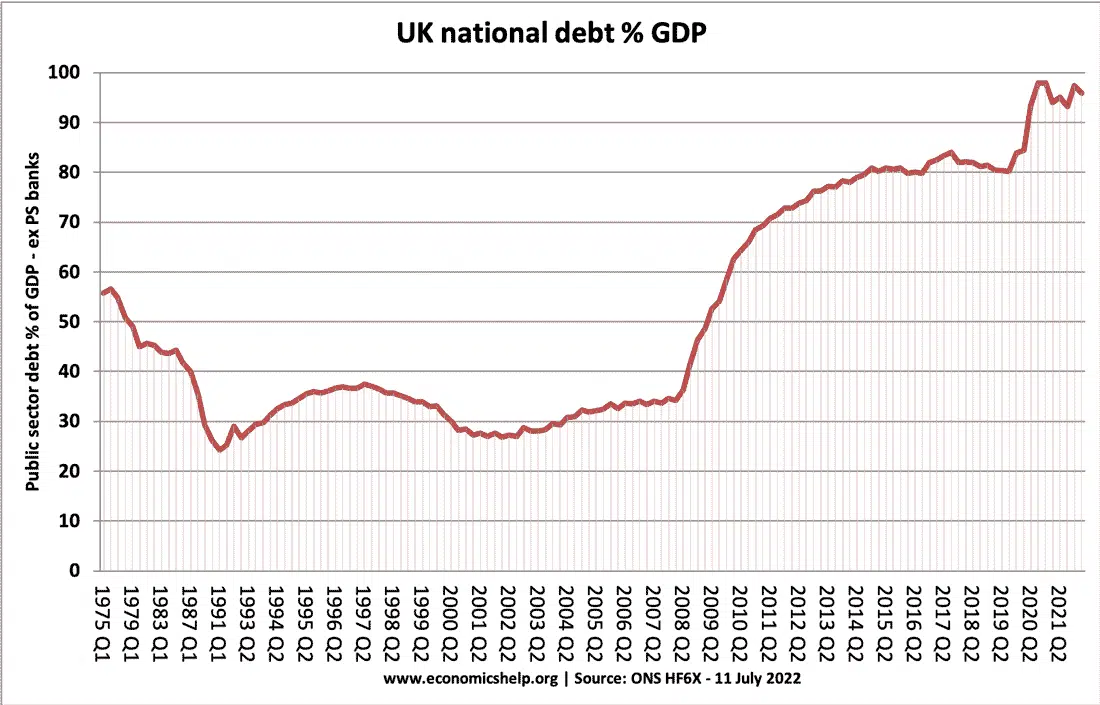

Can you explain in more detail what you are getting from that graph. Where is the GDP figure on that graph? You'd also have to factor in oil revenues and other factors. Tax burden chart below to see how it links with your graph should be strongly linked according to your analysis.UK national debt since joining the EU:

Membership coincides with the period of stability.

Low tax is the driving factor to enlarge the national debt. Brexit means even more low tax.

I would look at your chart and see historically we were still paying off our national debt from ww2 at the beginning then our economy had decent levels of industry and oil revenue at the beginning of joining however then we had a collapse in manufacturing as we couldn't compete in the EU and this took much time to deplete our manufacturing base, car manufacturing etc and I remember this all happening and then debts started rising. However its difficult to analyse as it doesn't have the gdp figure which is surely essential and you would have to factor in the oil revenues to see where they peaked as they were massive for some years.

Again it reads like people are trying to avoid the obvious truth that if you run a trade deficit or overall financial deficit you will get poorer and end up with more debt if you try to maintain your living standards without an income to support it. People keep throwing up stupid theories like low tax being the cause when there is an inherent structural problem with the economy because its running a large financial deficit.

Can someone please explain to me why they think you can run an economy with a large financial deficit, trading, sending money to the EU etc and somehow do well in that environment. It just seems like complete nonsense to me but I'm willing to listen to your viewpoint how that would work in the real world. Which countries have ever done well running a large trading deficit and giving out huge sums of money?

When I look at the EU you can see a huge number of countries like France, Spain and Italy have crippling debts.Strange then that the EU countries are now doing so better since we left, but our economy is now the one far worse than theirs overall.

All politicians, theirs and ours, are incompetent, simply because only idiots think they can have policies that suit a majority, when in truth a policy that suits more than a small minority is rare. It's the people, not the politicians who make a country, and for some 70 years we've had a terrible problem with productivity in Britain, seriously underperforming much of the advanced world.

For nearly half of that time we were not in the EU, so they could not have been to blame for its origin, which was entirely British. Once again, I was around to see all this happen, you either were not or were having your nappies changed at the time.

.

Over the next few years assuming we stay out of the EU these will be the benchmarks to see how our economy compares to theirs. Lets not pretend everything is rosy in the EU its is creating huge debts for many countries there. They are all making huge interest payments and their people are suffering. There was bound to be turbulence as we left the EU and then the pandemic hit adding a huge extra layer of debt. Also if you are comparing growth again this is a ridiculous way of comparing economies. Growth can mean more debt if it results in a higher level of imports. It's a balanced economy we should be looking for and a reduction in imports and increase in exports. Liz Truss's policies of high growth through huge additional borrowing was absolutely moronic. Many EU countries are getting growth through additional borrowing although not on the scale Liz Truss came up with I think. They are kickstarting their economies in a similar way. This might work for Germany or the Netherlands who have done well in the EU but is likely bad news for France, Italy and Spain in the long term.

the graph shows the national debt to GDP ratio. Vertical axis is GDP, the scale is 100% GDP, the horizontal axis is time, so you can see our borrowing against our ability to service the debt.Can you explain in more detail what you are getting from that graph. Where is the GDP figure on that graph?

You can see that our borrowing levelled at around 30% of our GDP during the membership period 1975-2008 until the subprime mortgage crash of 2008.

The EU's treaties are fundamentally there to ensure stability, countries are limited in how much they can borrow (3% of GDP) albeit that they all cheat with creative accounting, like Greece when they wanted to build for the Olympics.

2008-2010, Labour borrowed some to bail out the banks but the real hit is since 2010 until now, all under conservative government because of their low tax policy. Despite their effort to impose austerity on public services, they run such a high budget deficit in order to maintain low taxation on the rich. Imagine if they had taken 5% more tax a year, we wouldn't be where we are now. Large budget deficit has long term consequences. Interest accumulates, next government has bigger interest bills and the cycle will continue unless the next government reverses it.

The structural deficit that you often hear talked about is very real, that is because we voted for conservatives' low tax policy. The facts are all there, if you want to look into this.Again it reads like people are trying to avoid the obvious truth that if you run a trade deficit or overall financial deficit you will get poorer and end up with more debt if you try to maintain your living standards without an income to support it. People keep throwing up stupid theories like low tax being the cause when there is an inherent structural problem with the economy because its running a large financial deficit.

Imagine that Nigel Lawson did not abolish the 60% tax bracket for the top earners, corporation tax rate remains at 30%, there won't be any more generous tax free pension contribution up to £5 million a year (think how many people can use that perk) and a myriad of 'investment reliefs' that created a whole industry of tax avoidance.

That particular policy results in more people waiting for treatment and they can't work or worse, choose to go from working and paying taxes to not working and relying on welfare.

I can go on but you see the gist of what I am saying.

Related Articles

-

Swytch announce new conversion kit with ‘pocket-sized’ battery

Swytch announce new conversion kit with ‘pocket-sized’ battery- Started by: Pedelecs

-

New Swytch launches on Indiegogo, raises £100k in first hour

New Swytch launches on Indiegogo, raises £100k in first hour- Started by: Pedelecs

-

Swytch to unveil 70% smaller, 50% lighter conversion kit

Swytch to unveil 70% smaller, 50% lighter conversion kit- Started by: Pedelecs